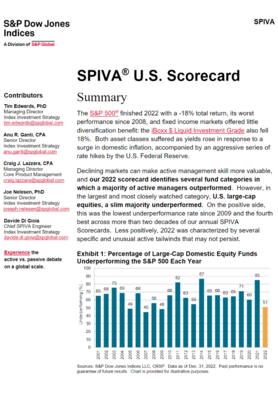

The latest SPIVA Scorecard provides an update on the active versus passive investment debate. Declining markets can make active management skills more valuable and our 2022 scorecard identifies several fund categories in which a majority of active managers outperformed. However, in the largest and most closely watched category, US large-cap equities, a slim majority underperformed.

On the positive side, this was the lowest underperformance rate since 2009 and the fourth best across more than two decades of our annual SPIVA Scorecards. Less positively, 2022 was characterised by several specific and unusual active tailwinds that may not persist.

More on Asset Liability Management

Browse categories

Back to Top

Back to Top